Insights

Get Approved Easier: Trovy's Enhanced Debt Consolidation Feature

December 08 2025

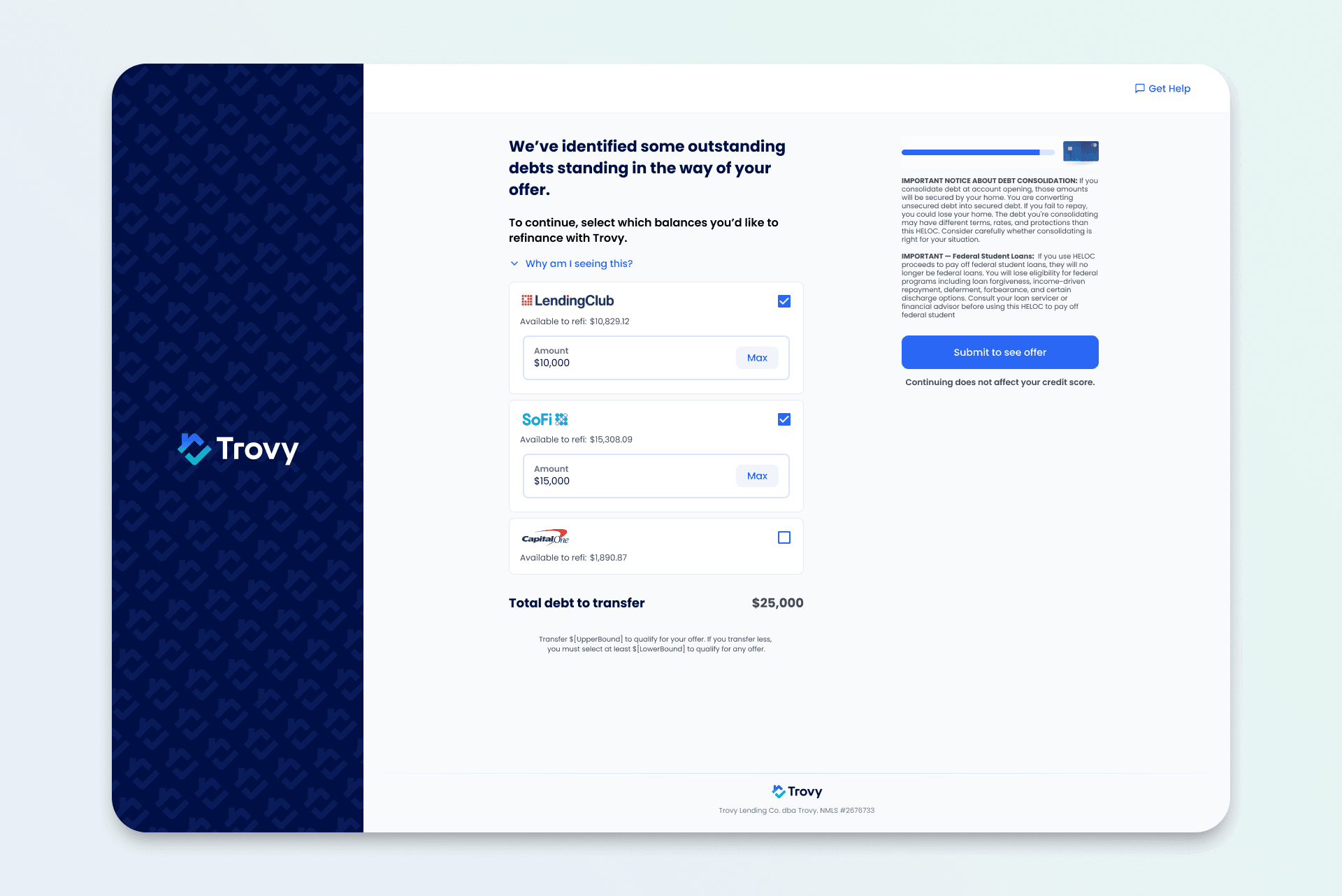

We’re excited to announce a major enhancement to Trovy’s debt consolidation: you can now select which debts to pay down directly in your Trovy HELOC application, and we’ll exclude those payments from your debt-to-income (DTI) ratio calculation to help you qualify.

What’s New

While Trovy has always offered balance transfers to pay down high-interest debt with your HELOC, we’ve made a game-changing improvement: you can now identify debts for consolidation during the application process, not after.

Why This Matters

By selecting credit cards and personal loans to pay off upfront, we can exclude those monthly payments from your DTI calculation. This seemingly small change can make a big difference:* you can increase your likelihood of approval by lowering your DTI ratio.

In other words, the debts you plan to eliminate with your HELOC won’t count against you when we’re evaluating your application.

How It Works

Simply choose which credit card balances and personal loans you’d like to consolidate during your Trovy HELOC application. Once your account is opened, we’ll pay down those selected debts directly, typically within 5-10 business days.

Then enjoy the benefits: lower monthly payments, reduced interest costs (HELOC rates are typically far below the 18-29% APR most credit cards charge), and the simplicity of one consolidated payment.

The Bottom Line

This enhancement puts the power of debt consolidation to work for you from day one. Instead of hoping you’ll qualify and then consolidating later, you can improve your approval odds and terms right from the start.

Ready to see how much easier qualifying could be? Start your application today and select the debts you’d like to leave behind.