Your home's equity,

in your wallet

Enjoy the low interest rates of a HELOC – with the flexibility and ease of a credit card.

Takes 2 min • No credit impact5

It's the most flexible HELOC on the market.

upfront draw required

lender fees due at closing4

draw fees on Trovy Card purchases

Why homeowners love the Trovy HELOC

-

Card-based access

Use your equity like a credit card, anywhere you need it

-

No upfront draw

Open your line and use it only when you're ready

-

Low interest rates

A fraction of credit card or personal loan rates

-

Minimal fees

No application, appraisal, or annual fees

-

Revolving credit

Draw, repay, and redraw as many times as you need

-

Rate flexibility

Choose variable or fixed rates based on your strategy

-

Fast & digital

Apply in minutes, close in days, not months

-

White-glove service

Real people who understand HELOCs when you need help

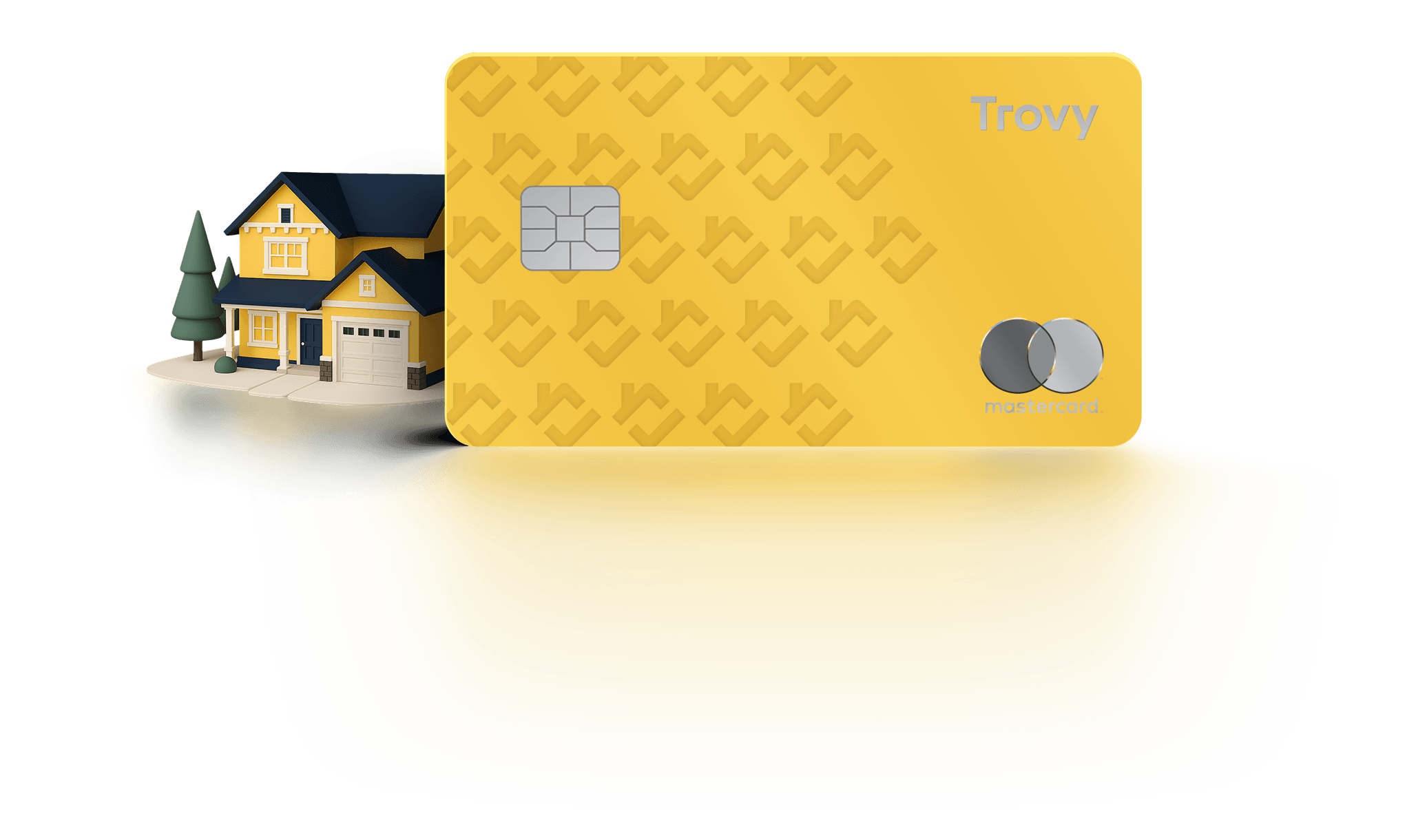

Mortgage rates, with credit-card convenience.

Your HELOC comes with a Trovy Card you can use anywhere Mastercard is accepted. In addition to the ability to withdraw cash or transfer balances, accessing your home equity is as easy as swiping a credit card.

Learn more about the Trovy Card

Why you'll love the Trovy Card

- 1.5-3% cash back on all card purchases

- No draw fee when you use your card

- Still only one monthly payment

- No interest if you pay off your balance

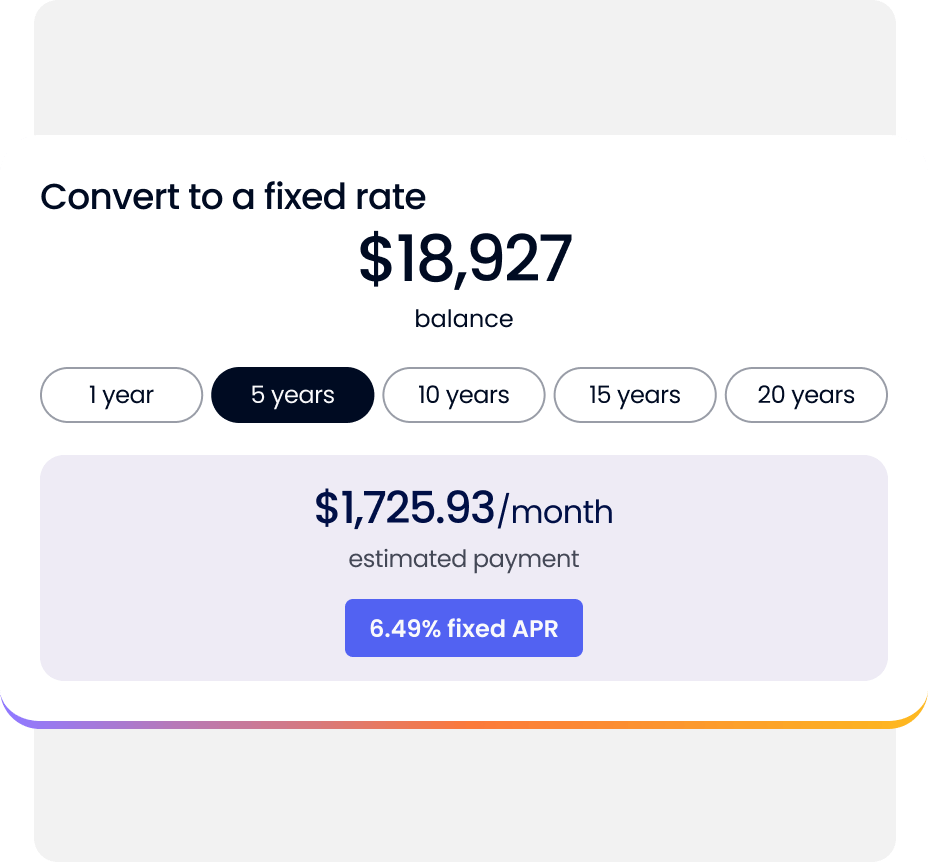

Want the certainty of a fixed rate? Sure thing.

The Trovy HELOC allows you to choose a variable or fixed rate based on your strategy. Use our innovative FixedPay feature to create a custom payment plan for any balance or transaction over $100. Choose from multiple repayment periods.

Try the Payment Calculator

Quick & easy to apply

Check your rate-

Check your rate in 2 min with no credit impact

Check your offer in under 2 minutes with no credit impact by providing basic information about you and your property.5

-

Apply 100% online and close with a remote notary

Accept your offer and sign your closing documents online – even the notary step is virtual and on-demand.8

-

Access your funds in as few as 4 days2

Transfer your high-rate balance, send cash to your bank account, and start spending with your Trovy Card.

What our customers are saying

Frequently asked questions

See allWhat makes the Trovy HELOC special?

The Trovy HELOC is the most flexible HELOC on the market. There is no minimum upfront draw so you can draw on your HELOC when you need the funds, and only pay interest on the amount you use. Your HELOC funds are easy to access - you can transfer money to your bank account, request a balance transfer, or use your Trovy Card wherever Mastercard is accepted. If you pay your balance in full each month, you won't owe any interest on your card purchases. You also pay no draw fees when you access your HELOC funds through the Trovy Card. It's a flexible, affordable, and modern borrowing solution for homeowners.

What is the Trovy HELOC Card?

With your Trovy HELOC, you will receive a Trovy Card that you can use to access your line of credit. You can use it for purchases or cash advances anywhere Mastercard is accepted, giving you flexible access to your home equity funds when you need them.

How do I take cash out with the Trovy HELOC?

You can use your Trovy HELOC to request an ACH transfer to your bank account, and you can use your Trovy Card to take cash out at an ATM. This gives you quick access to your home equity when you need it most. Each cash advance will be subject to a fee of up to 3% of the amount drawn, up to a 5% life of loan cap.

Does Trovy require an upfront draw or charge fees to access my line?

Trovy does not require any upfront draw when you open your HELOC. You can draw funds whenever you need them. While balance transfers and cash advances are subject to a draw fee of up to 3%, there are no draw fees on purchases made with your Trovy Card.

Are Trovy HELOC rates fixed or variable?

The Trovy HELOC starts with a variable rate, but offers you the best of both worlds. You can convert all or part of your balance to a fixed rate, locking in predictable monthly payments for that portion while keeping the flexibility of variable-rate borrowing on your remaining balance. This gives you control over your payment structure as your needs change. You can convert all or a portion of your outstanding HELOC balance at the end of any calendar month, or the full amount of specific purchases, cash advances, or balance transfers.