New: The Trovy HELOC is now live in California!

Get the low interest rates of a HELOC with the flexibility and ease of a credit card.

No impact to credit score5

compared to typical credit cards3

to access your funds2

Faster approval. Lower APRs. Lower monthly payments. It's flexible, and tax-deductible when used for home renovation.7 It's a no-brainer.

Low interest rates

Quick process

Flexible use

No min. draw

Bottom line

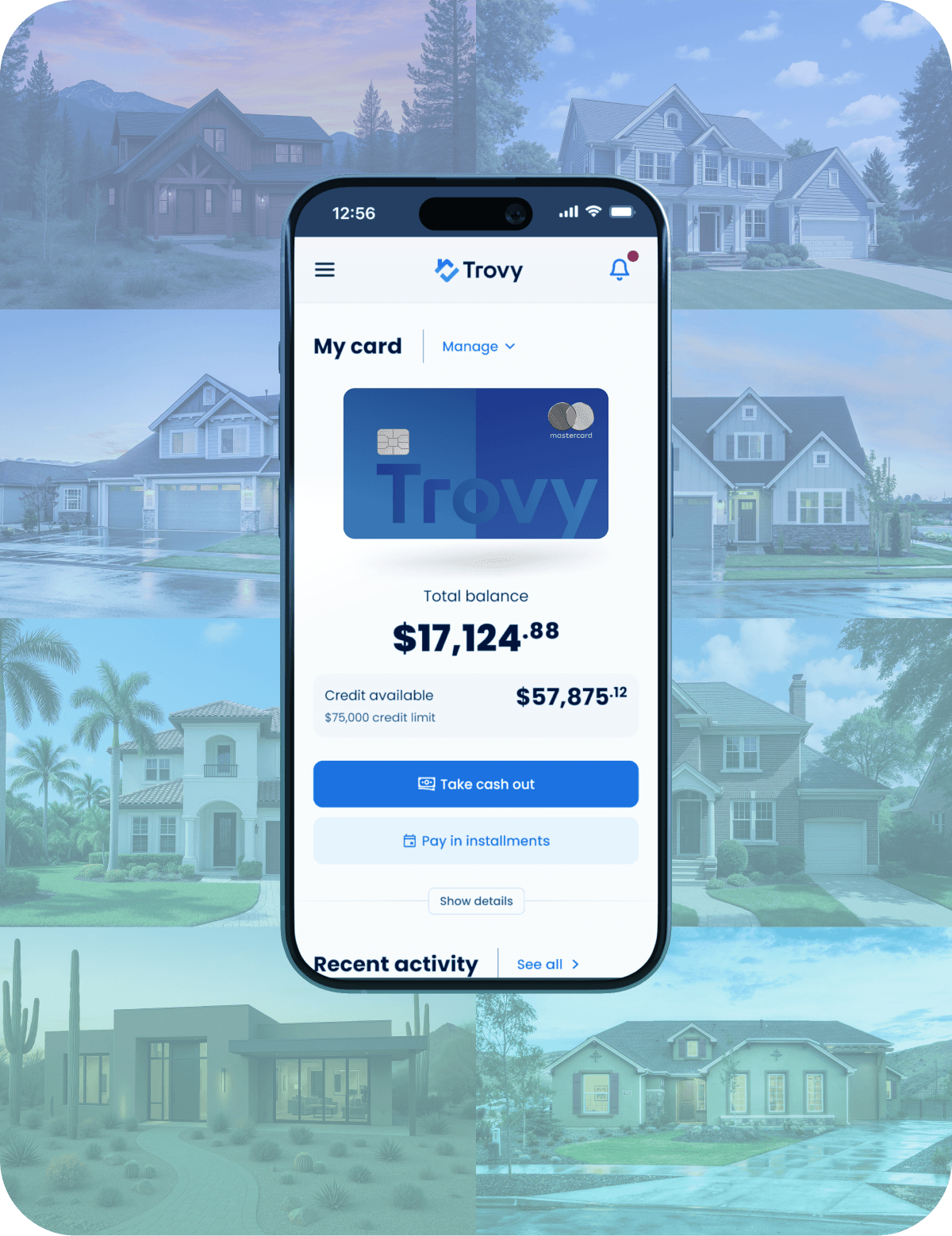

The Trovy HELOC is the most flexible HELOC on the market. There is no minimum upfront draw so you can draw on your HELOC when you need the funds, and only pay interest on the amount you use. Your HELOC funds are easy to access - you can transfer money to your bank account, request a balance transfer, or use your Trovy Card wherever Mastercard is accepted. If you pay your balance in full each month, you won't owe any interest on your card purchases. You also pay no draw fees when you access your HELOC funds through the Trovy Card. It's a flexible, affordable, and modern borrowing solution for homeowners.

With your Trovy HELOC, you will receive a Trovy Card that you can use to access your line of credit. You can use it for purchases or cash advances anywhere Mastercard is accepted, giving you flexible access to your home equity funds when you need them.

You can use your Trovy HELOC to request an ACH transfer to your bank account, and you can use your Trovy Card to take cash out at an ATM. This gives you quick access to your home equity when you need it most. Each cash advance will be subject to a fee of up to 3% of the amount drawn, up to a 5% life of loan cap.

Trovy does not require any upfront draw when you open your HELOC. You can draw funds whenever you need them. While balance transfers and cash advances are subject to a draw fee of up to 3%, there are no draw fees on purchases made with your Trovy Card.

The Trovy HELOC starts with a variable rate, but offers you the best of both worlds. You can convert all or part of your balance to a fixed rate, locking in predictable monthly payments for that portion while keeping the flexibility of variable-rate borrowing on your remaining balance. This gives you control over your payment structure as your needs change. You can convert all or a portion of your outstanding HELOC balance at the end of any calendar month, or the full amount of specific purchases, cash advances, or balance transfers.

Checking your offer won’t affect your credit score.5